64210ALL OSRAM ALL SEASON H7 Izzó, távfényszóró H7 12V 55W 3200K Halogén ▷ AUTODOC ár és vásárlói vélemények

6 db dedikált autós LED izzó készlet a Dacia Logan 2 2012 - 2020, Canbus teljes belső teréhez hiba nélkül, Xenon fehér, 3 W, 50 000 üzemóra - eMAG.hu

Vásárlás: DACIA LOGAN 2 2017.09. -2021.05 /L52/ Fényszóró jobb (H7/H7/LED) nappali fénnyel (motor nélkül) TYC 20-17585-06-2 Fényszóró árak összehasonlítása, LOGAN 2 2017 09 2021 05 L 52 Fényszóró jobb H 7 H 7 LED nappali fénnyel motor nélkül TYC 20 ...

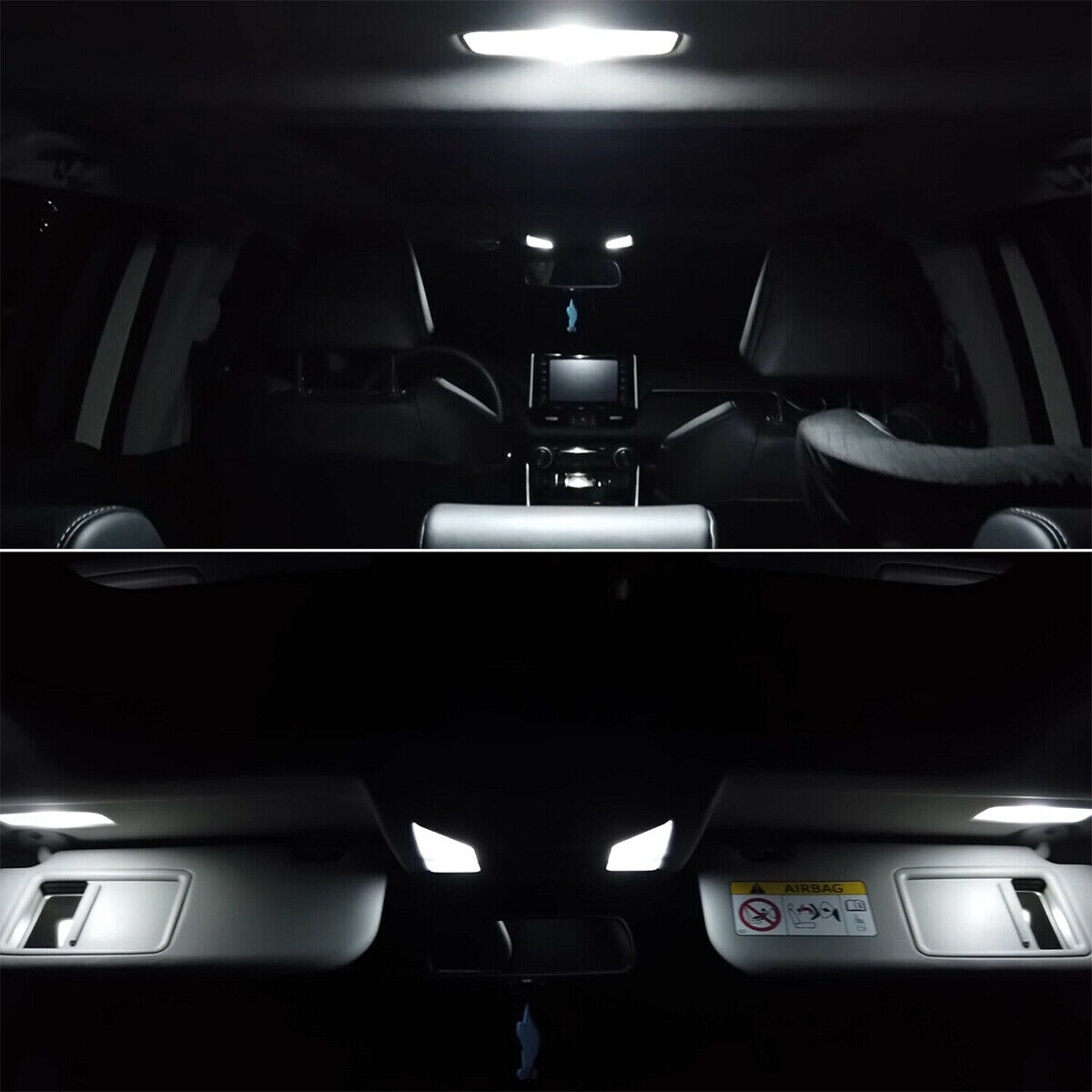

6 db dedikált autós LED izzó készlet a Dacia Logan 2 2012 - 2020, Canbus teljes belső teréhez hiba nélkül, Xenon fehér, 3 W, 50 000 üzemóra - eMAG.hu

6 db dedikált autós LED izzó készlet a Dacia Logan 2 2012 - 2020, Canbus teljes belső teréhez hiba nélkül, Xenon fehér, 3 W, 50 000 üzemóra - eMAG.hu

DACIA LOGAN MCV Kombi 1 2004.11-2008.12 /K90/ - Dacia - DACIA LOGAN MCV Kombi 1 2004.11-2008.12 /K90/ - Autozube M3 Autósbolt

DACIA LOGAN MCV Kombi 1 2004.11-2008.12 /K90/ - Dacia - DACIA LOGAN MCV Kombi 1 2004.11-2008.12 /K90/ - Autozube M3 Autósbolt